# Property CrowdFunding

# UK Property Crowdfunding: The Ultimate Guide

NOTE: This content was written in September 2016 so some examples may not have aged well.

Property Crowdfunding or ‘crowd-to-let’ platforms allow investors to buy shares in a property from just £10. Investors benefit from capital growth and rental income without the hassle of buy-to-let management and with the ability to diversity a lump sum across many properties. Investments can be in both commercial and residential property and can use leverage (mortgages) to increase potential price increases. These companies tend to set up a single ‘SPV’ (Special Purpose Vehicle) as a UK Limited Liability company for every new property asset. The number of property crowdfunding websites has absolutely exploded over the last year. Depending on how public opinion and government regulation responds, we can expect property crowdfunding to revolutionise the UK property market over the next decade.

# The Property Crowdfunding Business Model

Property Crowdfunding platforms source properties that they feel are undervalued, high yield or in areas with predicted house price increases. They use their experience and cash buyer’s advantage to find opportunities that inexperienced investors would not. They then charge fees, typically:

- A finder’s fee – often around 5% of the initial deal size. If the property is leveraged 50% this fee will usually be on the total value, not the investable value.

- An ongoing management fee – often around 15% of rental income.

- A sales fee – often 15%-25% of the capital increase of the property at the end of the term.

As private investors, we’d hope that the additional return from the platform’s expertise and discounted buying prices would offset much of the fees. Also worth considering: if you were managing your own buy to let property portfolio at arm’s length you’d often pay an ongoing management fee of 10%-15% to a local property manager.

# Strategy 1: High Yield, Discounted Properties

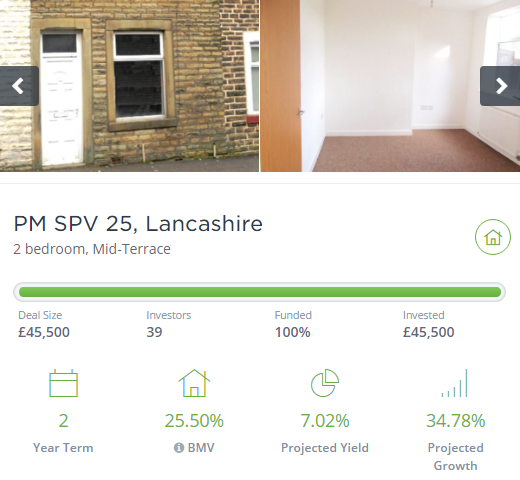

Property Moose for example tends to buy residential houses at discount prices in County Durham, Merseyside and Lancashire. These have high gross net yields of 6% or 7% after management fees and corporation tax but are areas that have historically not shown significant house price growth. Property Moose often buy at discounts to RICS valuation of 20%-25% and set aside a fund to ‘do up’ the houses to take them up to market valuation. Take for example this historical property deal:

In this case, they use their property investment experience and cash buyer’s advantage to source a £55,000 property for £41,000 (a 25% discount). They set aside some cash for repairs and unexpected costs, plus their management fees and other charges, which brings it up to £45,500 (still a 17% discount).

As I’ll mention in the section on Brexit below, recently platforms have shifted more towards this high yield strategy as concerns grow on the London property market.

# Strategy 2: Desirable Properties With High Price Growth

Another strategy is to de-prioritise rental income and focus on regions that are predicted to have the highest house price growth. The best example of this is the cross rail development in London. This should dramatically improve transport for residents who along the proposed rail/tube line. There’s a strong link in property prices and commute time, with some estimates putting the relationship at a £3,000 price increase for each minute saved of commute time. Crossrail has the potential to cut commute times dramatically, one example being a reduction of 21 minutes (‘£63,000’) for London Heathrow->Liverpool Street from 55 to 34 minutes. Jones Lang LaSalle (JLL) predict that house prices will rise over 50% along some places on the line between 2014 and 2020. They put the out performance of regions like Whitechapel or Woolwich up to 19% over and above London itself:

JLL Crossrail House Price Increases along line

JLL tipped Whitechapel to be the area with the highest price growth as a result of the crossrail development. You can read the investment case for Whitechapel put forward by Property Partner at the time here too. Let’s take a look at this example of a Whitechapel investment on the Property Partner website:

Property Partner crossrail investment

This property was bought for £435,000 in January 2015, a 17.1% discount to the market value at the time:

The property was offered for sale at auction on 3rd December 2014. However, this is a difficult time of year to engage most buyers and the property failed to sell. Suspecting the vendor was motivated to achieve a sale quickly, we made an offer after the auction below guide price and on the basis that we would exchange contracts before Christmas. The timetable slipped slightly to the New Year but we exchanged on 9th January for £435,000. The Chartered Surveyor’s report at purchase stated a Market Value (MV) of £525,000, so the purchase price for the property represented a 17.1% discount.

The property is let at £22,800 per annum, a gross yield of 5.2% on the initially discounted purchase price but before all charges and taxes. After all fees and charges the current net yield on this property is just 2.14%, a long way off the 6%+ net yield you see on Property Moose’s typical investments. However, investors in this property have seen massive capital growth. As of September 2016 the latest Surveyor’s valuation values it at £611,107 whilst it’s trading on the secondary market at around £590,000. This shows a capital growth of between 30.5% and 35.2% over a 21 month period for initial investors who bought in at £452,200. This gives an annualised capital growth of around 18%, with 2%+ rents paid as a monthly dividend on top.

The future is uncertain for these capital growth gains in the London property market, and Property Partner themselves appear to be diversifying into non-South East investments in the latest offerings. This strategy may continue to work with large infrastructure projects such as HS2 in Birmingham.

# Strategy 3: Co-Investment in Private Equity Deals

This is a more recent innovation. There are large property projects that were traditionally only within reach of institutional investors or ‘ultra’ high net worth individuals. Recent examples of this were an £18 million redevelopment of care homes and a £65 million student accommodation portfolio. The property platform may partake in a small percentage of the overall deal, perhaps just 5%, then re-offer this investment to its members. These can be attractive as they may offer higher returns than a traditional property investment by their high barrier to entry. However, they can also be complex and come with higher management fees.

# Strategy 4: Loan Products

Platforms have started offering property loans. These may be to help finance their own property acquisitions or as finance for other business redevelopment projects. Rates are usually around 8%-9%. The House Crowd has many of these loans, and Property Moose have started recently too. In my opinion, you can find higher rates of return on the dedicated secured peer-to-peer lending websites like Saving Stream or Funding Secure who offer returns of 12%+ per annum.

# Advantages for Investors

# Diversification

Research suggests that traditional real estate investors should hold at least 20 properties to reduce their risk (link to paper). The peer-to-peer lending platform Funding Circle have a great example (here) which illustrates how rates of return distribute more regularly after 100 different loans. Crowd-2-Let platforms let investors easily split their funds across different properties and UK regions. This spreads the risks of vacant lets, unexpected costs and regional housing market downturns.

# Ease of Management

There’s nothing worse than an angry wake-up call from a resident after the boiler’s broken on a chilly February morning. Dealing with local property management companies can have its difficulties too. Investing via a property investment platform gives you peace of mind for a typical 15% ongoing management fee.

# Management Expertise & Experience

The investment decisions are made by people with a lifetime of experience in property investment. If you trust in their experience, you’d hope it would lead to greater returns in the long term – that their choices would more than cover the fees.

# Other Benefits

Taxation: Within an SPV, rental income and capital gains are taxed with corporation tax at 20%. Unlike private renting, interest payments for limited companies are classed as a business expense and so are fully deductible against income. Investors pay further tax depending on their personal circumstances, but the smallest investors are unlikely to breach the tax free £5,000 dividend income limit. Although buy-to-let investors adding additional properties to their portfolio could now choose to do so via an SPV, this would incur additional administration/accountancy fees. In the near future, if the government follows through on plans to cut corporation tax to between 15% and 17% as soon as 2020 this will further reduce the tax paid on capital gains for properties sold after (many run for 5 year terms).

# What is an SPV?

An SPV, or Special Purpose Vehicle, is a UK limited company that is set up to manage the property assets.

SPVs pay the additional 3% Stamp duty land tax. From Property Partner’s FAQs:

Following the March 2016 budget, as from April 2016 purchases of a second residential property in England, Northern Ireland or Wales are subject to an additional 3% Stamp Duty Land Tax (“SDLT”). In the case of companies and non-individuals (such as our SPVs) first purchases of such properties are also subject to the additional 3% Stamp Duty Land Tax. There are no exemptions. However, if we are acquiring more than 6 units we also have an option to elect SDLT for non residential and mixed use land and property rates. This typically applies to commercial property but can be adopted for residential property in certain circumstances i.e. if purchasing more than 6 units in a transaction.

# Typical Fees & Taxes

# Fees:

A buyer’s/finder’s fee. Property management fees. Performance management fees on the eventual sale of the property. Buying/Selling fees on secondary markets.

# Taxes:

Tax on dividend income over £5,000. Capital gains tax on shares sold via secondary markets. Stamp Duty Reserve tax, a 0.5% tax on cost on purchasing shares on secondary markets. Funding Methods Platforms use either a ‘first come first served’ model where a new investment is listed on a pre-announced date, then investors buy portions of the investment until it is fully funded. A second funding model is to have a set period for pre-bidding. At the end of the period, for example one week, all the bids are scaled back if the offer is oversubscribed.

# Themes in UK Property

UK House Price Index

# Brexit

Following the Brexit vote confidence in the UK property market was put to test. Open-ended property funds were the first major casualty, with many halting withdrawals and rushing to sell off some of their investments to raise cash. In the months since then, the apocalypse has not yet struck property markets and there is some hope that a housing market downturn can be avoided. Recent data from the RICS residential market survey suggests price growth across most of the UK, but the future is less optimistic for London. Since Brexit, property crowdfunding platforms that traditionally focused on London and the South East have started listing more Northern and Midlands properties.

# Interest Rates & Mortgage Availability

Dropping interest rates may open the doors for further house price growth across the UK. However, mortgage availability is still tight for many.

# BTL Taxation

The government is making life harder for traditional buy to let investors with two major changes:

A stamp duty surcharge of 3% over the standard rate of stamp duty. The staged removal of mortgage interest relief. ‘Subject to consultation‘, from April 2017 HMRC will start to charge a 3% surcharge over and above the standard rate of stamp duty. This would lead to the following second home/buy-to-let stamp duty changes:

Stamp duty surcharge ratecard

Source: Government Consultation Outcome Document (link)

Between April 2017 and 2020 the government is phasing the reducing the maximum level of mortgage interest relief for private landlords down to 20%. For higher rate tax payers, this would could significantly reduce their net income. Basic rate payers may also find themselves being pushed into the higher rate tax bands due to the way income tax bands will be calculated. To understand these changes better, here’s a fantastic worked example from London & Country.

A third smaller change is the way HMRC treats ‘wear and tear’ expenses. Previously buy-to-let owners could deduct a flat 10% of rental income to pay for general costs, but now they can only submit actual expenses for replaced furnishings.

These changes are forcing buy-to-let investors to reassess their investment options. As the changes sink in, we may see less interest from traditional BTL’ers in increasing their portfolios – especially if the 3% stamp duty surcharge is added next April. This space could be filled by crowd-to-let platforms who can maximise their tax advantages.

# An Alternative to Property Crowdfunding

Property Partner, the largest crowdfunding platform, advertises estimated returns of 10% after fees and taxes. This is dependent on a healthy property market: if there’s a general downturn in house prices then actual returns will be lower than this. One alternative investment worth exploring is short term property bridging finance or general property lending. Many property developers need short term funds to finance their property project before resale and often pay high short term rates against a reasonable Loan-To-Values of 70% or less. You can buy these loans on peer-to-peer lending platforms like Saving Stream with a 1% monthly return and provision fund against losses. Like property crowdfunding this is also dependent on a healthy property market where developers can complete their deals successfully and LTV’s can be achieved on resale if needs be. There are a number of advantages to this alternative:

Currently higher liquidity to sell at par on secondary markets – most property crowdfunding sites don’t even have a secondary market. More predictable income. Shorter term turn around: typically 6 months as opposed to 2-5 years. Higher expected rates of return: some peer-to-peer lenders which make many property loans advertise expected rates of 11% or more (e.g. Funding Secure, Saving Stream). Avoids some taxation like stamp duty. However there’s disadvantages in the lending alternatives too:

Different treatment of taxation: interest income from lending has a limit of £1,000 tax free per year before being taxed at your marginal rate. Property Crowdfunding has a higher dividend income limit of £5,000 tax free per year before being taxed at your marginal rate. A different treatment in the case of the platform itself going under. Direct share ownership of the underlying property SPV may make it easier for investors to recover funds. Lending can be more complicated with different batches of loans made with first, second, third charges on the underlying property itself. In these cases a default with on an overvalued property could mean those with lowest priority get nothing.

# Resources

These are resources such as forums, blogs or research papers that I’ve found interesting and are worth a look.

# Online Communities & Forums

P2PIndependentForum. This is a general P2x investment forum but has sub-forums for Property Moose and Property Partner (link to subforum). Property Partner Investment Discussion Group, a closed Facebook group to protect against spam but open to requests from ‘real’ members (link). Property Tribes. An active forum for UK buy-to-let investors (link to trending posts).

# Property Investment Websites & Blogs

GlobalPropertyGuide. Most widely used for investing in foreign properties but also nice as an outsider’s overview to the UK market (link to UK overview).